Templates for Credit Card Authorization Forms

When you accept payment using a credit card without the actual card being there, it can be risky. To protect yourself from this risk, such as from chargebacks, you might request your customer to sign a paper giving you permission to charge their card regularly. This paper is known as a credit card authorization form.

Table of Contents

ToggleWhat is a credit card authorization form?

A credit card authorization form is a document that gives permission to someone to charge a credit card for a specific amount of money. It’s like giving the okay to use your card to pay for something.

A credit card authorization form is like a permission slip. It’s a paper that a person signs to let a store charge their credit card regularly. This could be for things like monthly bills or other recurring payments. The form gives the store the okay to charge the card whenever they need to, whether it’s every month, every few months, or less often.

Can forms for credit card authorization stop people from abusing chargebacks?

Chargebacks are when customers say they didn’t make a purchase and ask the bank to get their money back. This can be a problem for businesses because they might lose the money temporarily while the bank decides what to do. Chargebacks also take up a lot of time and paperwork for businesses.

To avoid chargebacks, businesses can use a form where customers agree to pay for the services they receive. Having this signed form makes it easier for the business to prove their case and get their money back if there’s a dispute.

If I’m selling things through Square, when should I fill out an authorization form?

Credit card authorization forms are really helpful for repeat transactions. This could be when someone pays without being physically present or when their card details are already saved. These forms serve two main purposes: they reduce the risk of customers disputing charges they actually made, and they save everyone time.

Imagine you own a restaurant that regularly delivers lunch to a nearby office. If you have an authorization form on file, it means you can charge that office’s card every time they order, without having to ask them again and again. This saves you from having to confirm payment methods or ask customers to sign for each delivery.

But using an authorization form isn’t just for recurring payments. You might also use it to take a deposit for something you’ll buy later, like goods, services, or extra costs.

This is useful if you have a business where you rent out expensive equipment. You can use the authorization form to temporarily hold money on a card until the equipment is given back.

What’s in a credit card authorization form?

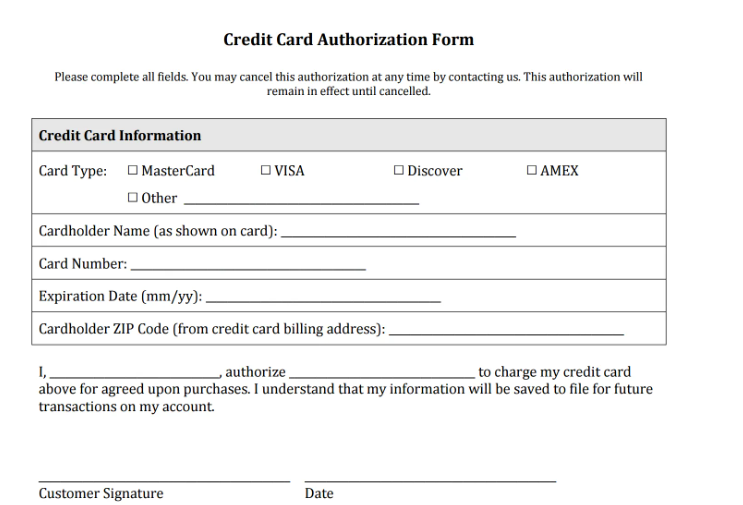

A credit card authorization form isn’t hard to understand. It usually includes:

- Your credit card details: like card type, name on the card, card number, and expiry date.

- Information about the business you’re buying from.

- Your billing address.

- A statement allowing the business to charge your card.

- Your name and signature.

- The date.

Get our templates to begin.

Square offers two free generic credit card authorization forms for download. You do not have to process payments with Square to use these templates.

You can use these forms as-is or edit them to include your business’s name and logo or specific language related to the use of the card. You may want to talk to your lawyer about the type of language that your business should include on the form.

FAQ

Do I have to use credit card forms by law? Credit card forms are a good idea for businesses, but you don’t have to use them. It’s best to check with your lawyer to see when they recommend using one.

Why doesn’t this form have a spot for the CVV number?

It’s against the rules to write down a customer’s CVV number for security reasons. That’s why there’s no space for it on the form. If you need to manually enter a payment, you’ll have to ask the seller for the CVV each time. If you use Square’s Card on File feature, you won’t need to do this.

What is Card on File?

It’s a way for businesses to store their customers’ payment info safely with Square. This makes it easier to charge regular customers online or in person, whether through your POS system, Square Invoices, or our eCommerce API. If you usually take payments remotely by typing in card details, Card on File lets you charge customers in the future without any extra steps.

How should I keep signed forms and for how long?

To follow security rules, keep completed forms in a safe place like a locked room or filing cabinet. Only let employees who need it see the forms. You can also keep forms in a private, encrypted client portal using a secure file transfer app. Sending forms by email can be risky, but if you must, password-protect the PDF and use encrypted email.

Because chargeback deadlines can vary, it’s smart to keep signed forms for two to three months after you stop charging the card. Or, if you use Square, you can store card info using the Card on File feature.

Download template

follow The White House is talking to lots of people who create stuff online .